Ensure employee trading and investments meet all regulatory and internal policy requirements.

Gain comprehensive pre-clearance and post-trade oversight across 35+ exchanges, 30+ blockchains, 200+ tokens.

Simplify declarations for employees holding non-publicly traded investments.

Track and report gifts and hospitality—given or received—to stay compliant with anti-bribery regulations.

Easily capture and manage employee disclosures for external business engagements.

Enforce pay-to-play thresholds and minimize employee-related risk with purpose-built tracking and controls.

Automatically compare firm trades against watch lists and restricted lists to detect and investigate potential trading risks.

Streamlined broker-dealer licensing and registration processes for employees and compliance teams.

Automate and standardize sales oversight to ensure every interaction meets compliance and conduct standards.

Meet regulatory requirements across the UK, Singapore, Ireland, and Australia.

Track employee training, manage certifications, and ensure ongoing compliance through customizable oversight and reporting.

Centralize MNPI oversight with tools for wall crossings, insider lists, restricted lists, and more.

Manage conflicts, monitor deal teams, and streamline wall crossing workflows with StarCompliance Enterprise.

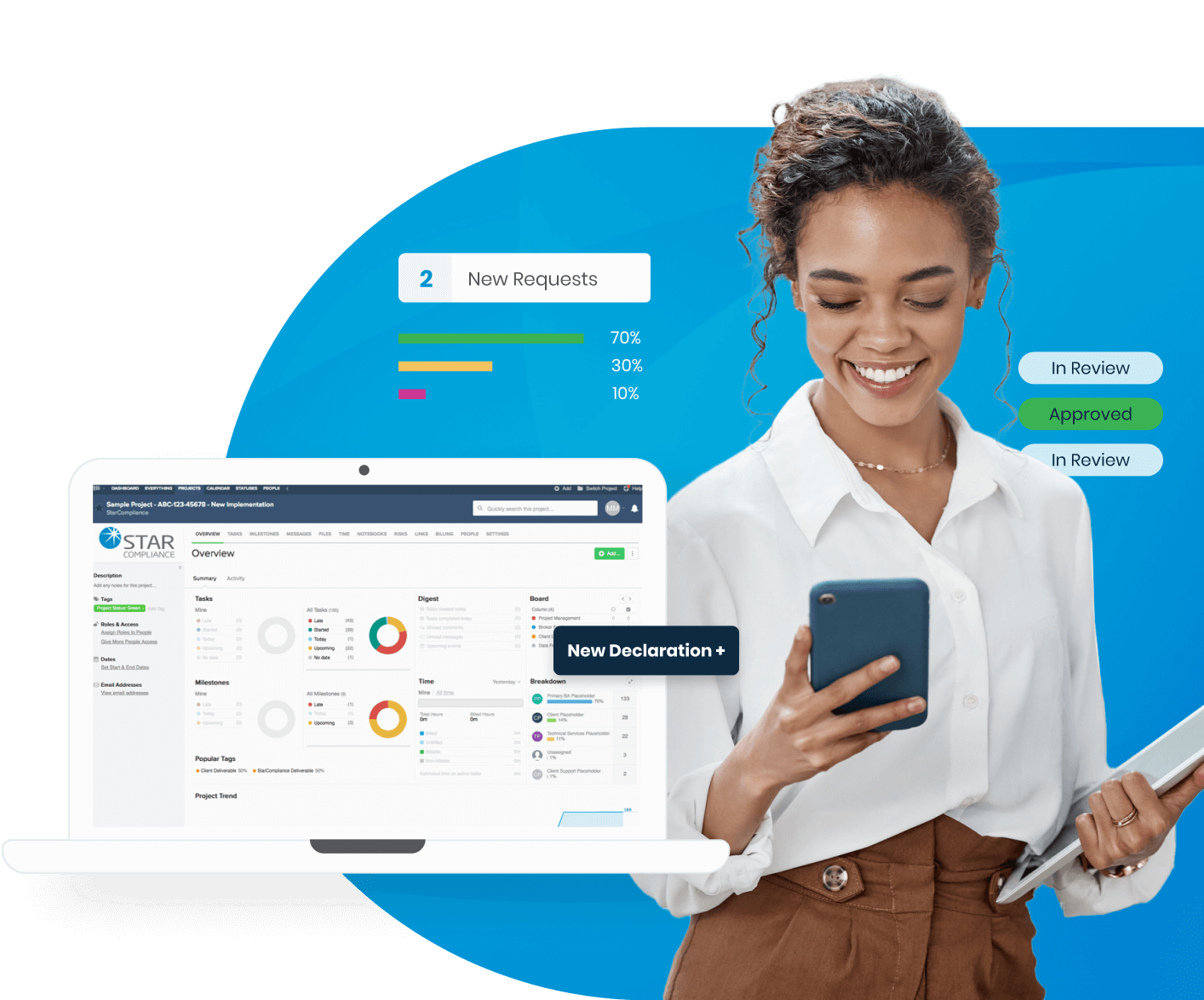

On-Demand Configurability

Extensive workflows are highly configurable, powered by conditional logic.

Multi-Jurisdictional

Tailor time zone, currency, language, and more for global employees.

Intuitive UX

Drive employee adoption with ease and simplify employee access via standard authentication and/or single sign-on.

Actionable Intelligence

Quickly and easily get real-time analytics through customizable dashboards and reports.

Multi-Layered Protection

Safeguard sensitive data with multi-layered access rights based on division, department, role, location, and more.

Future-Ready Architecture

Gain a 360-degree view of your employee compliance anywhere with scalable, cloud-ready software and integrations with Snowflake, Thoughtspot, and PowerBI.

Star Technology

Advanced implementation and security options ensure your compliance operations are safer and more efficient than ever before.

Star Security

Comprehensive governance, risk, and compliance security provide the ultimate protection for your data.

Data Management

A range of products, services, and vendor solutions that let you monitor and manage an ever-increasing amount of data, enhance and optimize existing data sets, and maintain data integrity.

Reporting & Analytics

Be proactive, not reactive. Put actionable intel in front of compliance officers and frontline managers in an interactive format in near-real time.

Star Mobile

With STAR Mobile, employees pre-clear activity and report transactions on-the-go and Supervisors can review escalated requests from anywhere.

GuideMe

GUideMe is your compliance software training partner. Get instant support from inside the application.

Next Generation Employee Compliance Solutions

Trusted by firms around the world