Liability Management, Defaults, and the MNPI Risk Hiding in Plain Sight

This discussion connects the current liability management cycle with how organizations approach material, nonpublic information (MNPI), conflicts, and trading oversight.

Our solution was designed to create transparency and to simplify critical workflows between employees, the business, and compliance.

Centralize MNPI oversight with tools for wall crossings, insider lists, restricted lists, and more.

Manage conflicts, monitor deal teams, and streamline wall crossing workflows with StarCompliance Enterprise.

Complete marketing and advertising reviews faster with AI assistance.

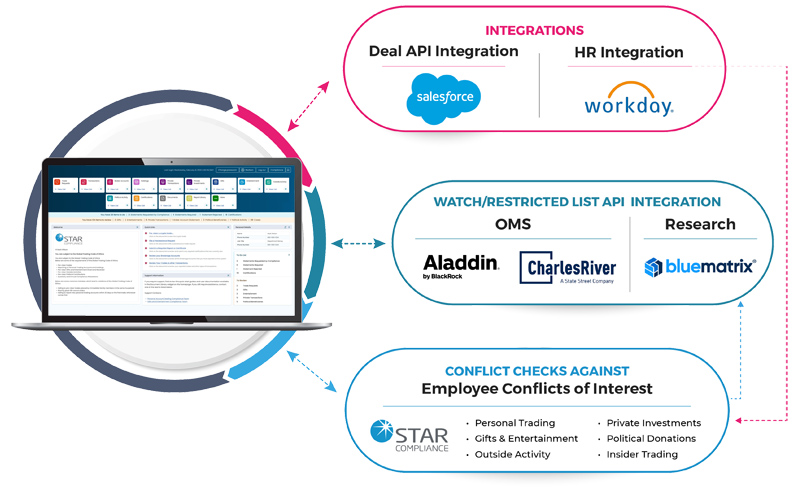

Gain greater clarity into the web of connections between employees, the enterprise, and clients by utilizing Star’s Conflict Search API. Expand your search parameters beyond the Star solution suite and tap into loan portfolio systems, trade order management platforms, research systems, and more, to surface connections and potential conflicts within seconds.

The API is lightweight, easy to setup, and doesn’t require formal integration points between systems. Users have complete control over the specific data points to be searched, the data refresh frequency, and the level of detail be populated back into STAR. This limited, controlled data access minimizes the amount of data exposed between systems while keeping data accessibility and visibility intact.

Expand conflict searches beyond data housed in STAR to include data residing in other enterprise systems.

Significantly reduce manual effort and the risk of conflicts going unnoticed.

Gain a more comprehensive view of relationships across the enterprise, employees, and clients.

Clear activities and business dealings with speed and confidence.

Document and resolve conflicts from a centralized location and generate a clear audit trail of approvals and investigations.

Surface conflicts quickly across deals, employees, and related parties and integrate with other key systems to extend your search.

Maintain watch lists and restricted lists from one system and utilize them to restrict activities against specific companies or securities.

Create and maintain lists of individuals by deal or project who are aware of, or have access to, related Material Non-Public Information (MNPI).

Document and monitor requests and approvals and attach them to related deals or projects within the system.

Maintain a detailed audit trail for every creation, change, or deletion throughout the lifecycle of a deal or project.

Empower employees to self-report MNPI by giving them access to STAR’s employee portal.

Call upon critical data from existing firm systems by integrating your deal management, order management, human resources, and research tools to gain an even wider view of firm activity.

The enterprise software shown in this graphic are not an exhaustive list of Star’s integration capabilities.

Both regulators require that said lists must include:

Whether deal-based or permanent insiders, StarCompliance Enterprise makes it easy for firms to collate, maintain, and update Insider Lists with ease and efficiency in one central location—all in the name of protecting market integrity.

Extensive workflows are highly configurable, powered by conditional logic.

Tailor time zone, currency, language, and more for global employees.

Drive employee adoption with ease and simplify employee access via standard authentication and/or single sign-on.

Quickly and easily get real-time analytics through customizable dashboards and reports.

Safeguard sensitive data with multi-layered access rights based on division, department, role, location, and more.

Gain a 360-degree view of your employee compliance anywhere with scalable, cloud-ready software and integrations with Snowflake, Thoughtspot, and PowerBI.

This discussion connects the current liability management cycle with how organizations approach material, nonpublic information (MNPI), conflicts, and trading oversight.

Is Your Insider-Trading Program Ready? The UK’s Financial Conduct Authority (FCA) has recently charged two individuals with insider dealing after identifying suspicious trading linked to confidential takeover information.

After months of muted activity, global M&A and leveraged finance markets are finally gaining momentum.