5 Key Data Streams for 360-Degree Compliance Control Room Solutions

Control room officers can struggle to monitor the constant flow of deal-related activity and information. In this week’s StarBlog, StarCompliance CEO Jennifer Sun discusses how software can bring clarity to the control room

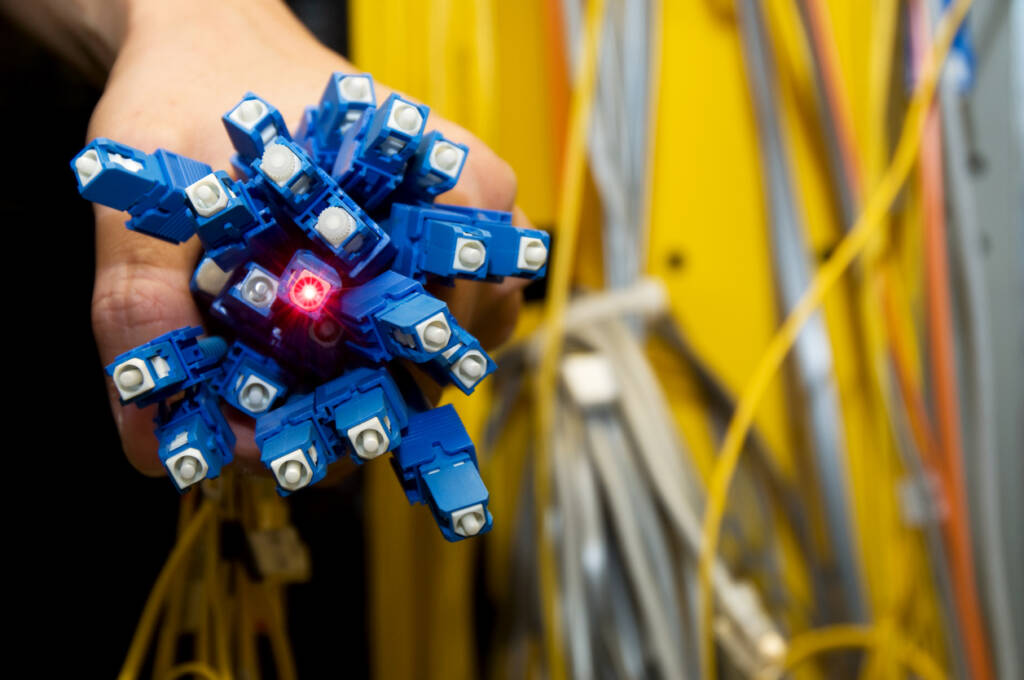

Hundreds, if not thousands, of deals are moving through a firm’s pipeline at any given moment, and each of these deals may involve a correspondingly high number of employees. Compliance officers must manage the flow of deal-related information to ensure no one abuses material nonpublic information (MNPI) for personal gain, and control rooms serve as the nerve center through which all of that data must pass. For a control room to effectively build a complete view for compliance officers, it should tap into the following information streams:

1. WATCH AND RESTRICTED LISTS

Watch and restricted lists are two foundational means of reducing the chances of market abuse within a firm. However, the aggregation of relevant data into these lists isn’t always as timely as it should be. This can jeopardize business and ultimately result in regulatory action. Bankers, traders, salespeople, and research analysts must all report to the control room when they receive MNPI, intentionally or not. And they must understand what types of information should trigger this action.

In addition, the speed with which they report said MNPI is critical. When bankers believe a new deal is on the horizon, for instance, they should immediately report that information to the control room. It’s then the job of control room officers to determine whether the company the MNPI refers to should be added to the list (or when it’s appropriate for that company to be removed). Whether it’s ingesting watch and restricted lists from another source or using control room software to maintain these lists, the ability to easily access and maintain this information is key to compliance departments and the control of firm risk.

2. TIMELY DEAL DATA

For control room officers to detect potential conflicts among high volumes of transactional information, they need all deal-related data to be as timely as possible. Beyond MNPI, they must also be apprised of new deals, the internal and external players involved in them, the activity of all members on the deal team, any wall-crossing requests, etc. Control room officers can either ingest this information from a CRM or deal-management platform, or provide a way for employees to easily enter new information into control room software. Whatever the method for capturing data, the key is that it must be timely. Control rooms need each new piece of information integrated into the overall picture quickly and completely, not piecemeal over days or weeks.

3. WALL-CROSSING APPROVALS

Firms must place barriers, whether physical or digital, between employees who have access to MNPI (deal-side employees) and those who work with securities transactions (e.g., trading, sales, research, etc.). The first step is to decide which employees fall into the following categories: public-side, private-side, and above-the-wall (management, compliance, legal, etc.) Human resources applications can help firms assign these categories and build hierarchies and structures around them.

The information stored in an HR application can then feed into the control room, so control room officers can see at once who should and should not have access to certain data—and what role, if any, employees have on the deals in play. Only then can the appropriate walls be created to prevent the flow of MNPI and, subsequently, the prevention of market abuse. If someone requests approval to cross the wall—like a deal-side employee requesting a meeting with a research analyst—control room officers have immediate access to the information they need to approve or deny that wall crossing. They can then add that employee to the necessary watch lists for the remaining lifecycle of that deal.

4. TRADING DATA FROM EMPLOYEE CONFLICTS SOFTWARE

It should go without saying, but your employee conflicts of interest monitoring software should integrate closely with your control room. Control room officers need to have employee trade-related data readily available to connect dots easily and conduct the due diligence necessary to uncover any conflicts between employee activities and the deal teams those employees serve on. Integration between the control room and employee conflicts software enables both pre- and post-trade risk assessment and investigation by correlating employee access to MNPI with recent trade activity. This makes it simple and efficient for compliance teams to identify trends that could point to code of conduct or regulatory infractions.

5. ELECTRONIC COMMUNICATIONS

Because MNPI is often shared through digital means—especially with financial services teams more physically dispersed due to the pandemic—compliance officers must monitor electronic communications closely. Control rooms need a way to audit incoming and outgoing communication in real time, so officers can detect the relay of MNPI, relationships of interest, sales and trading activity versus customer communication patterns, and so on. Email, phone, calendar entries, Bloomberg terminal, and other commonly used messaging and social networking platforms should factor into the control room calculation. If you use software systems today to monitor these communication vehicles, integrating them with your control room software will further reduce firm risk.

Monitoring the increasingly dense and complex flow of deal-related activity and information is a tall order for any compliance officer, which is why many firms are increasingly looking to advanced control room software for help. Good software enables integration with your existing systems to aggregate disparate data—such as the information from the streams above—into one central view. This way, compliance officers can maintain full oversight and make informed decisions.