Australia’s Capital Markets Are Evolving…

And So Are Regulatory Expectations

The Australian Securities and Investments Commission (ASIC) has released a major discussion paper highlighting the dynamic shifts between Australia’s public and private capital markets. As private markets expand and public market participation declines, ASIC is calling for feedback—and potentially new regulatory approaches—to preserve market integrity, transparency, and investor confidence.

Key Takeaways from ASIC’s Discussion Paper:

Public and Private Markets Are Interconnected

Both sectors are critical to Australia’s economic health. However, the declining number of listed entities and growing reliance on private capital raises risks around transparency, governance, and systemic stability. The chart illustrates the breakdown of public and private markets.

New Risks in Private Markets

ASIC identifies opacity, valuation uncertainty, illiquidity, conflicts of interest, and leverage as key risks associated with private market growth. These factors create challenges for investor protection and market surveillance. According to the ASIC Discussion Paper, here are the highlighted focus areas:

Regulatory Review & Stakeholder Engagement

ASIC is evaluating Australia’s capital markets and exploring ways to improve investor outcomes and capital raising, including:

- Engaging with stakeholders on developments in public and private markets, both domestic and international

- Reviewing listing pathways and rules with the ASX

- Consulting in 2025 on portfolio holding disclosure relief for private credit investments in superannuation funds

Market Integrity & Cleanliness Monitoring

ASIC is expanding its surveillance efforts to enhance trust in public and private markets, including:

- Monitoring public debt markets for unusual trading around major events and issuances

- Reviewing information handling and potential conflicts in ‘take-private’ deals

- Applying equity market surveillance techniques to private transactions

Increased Surveillance of Private Market Activity

ASIC is intensifying oversight in areas such as:

- Corporate advisers: governance, conflicts, insider trading, and information protection

- Private equity and credit funds: governance, valuations, conflicts, and fair investor treatment

- Retail private credit funds: disclosure, liquidity, distribution, and credit risk

- Super funds: valuation and audit practices

Public and Private Market Growth

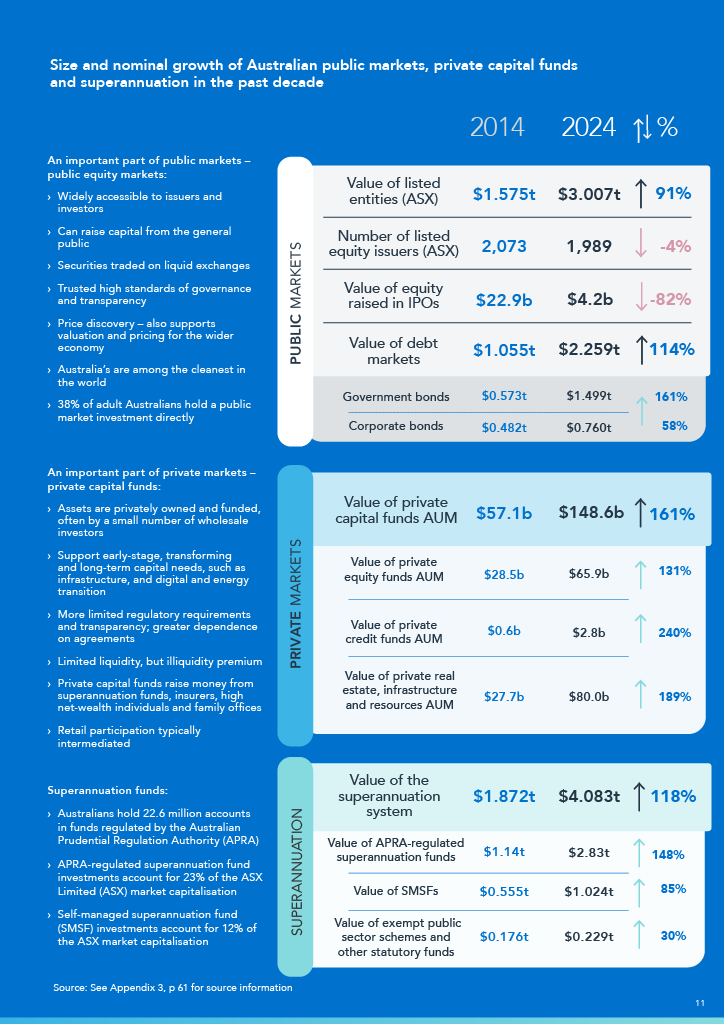

According to ASIC’s research (see below), Australia’s capital markets are composed of both public and private sectors, each playing a vital role in the economy. Public equity markets offer broad access for issuers and investors, enabling capital raising from the general public through liquid, transparent exchanges with trusted governance—38% of Australian adults hold investments in these markets. In contrast, private capital funds are typically accessible to wholesale investors and support long-term and transformative projects with less regulatory oversight, limited liquidity, and reliance on bespoke agreements. Superannuation funds are deeply embedded in both sectors, with APRA-regulated and self-managed funds collectively accounting for 35% of the ASX’s market capitalization, making them critical players in Australia’s investment landscape.

Market Integrity

As described below, ASIC is actively working to prevent information leaks and insider trading that threaten market integrity and the attractiveness of Australia’s capital markets, urging all parties involved in public and private transactions to implement robust controls, manage confidential information responsibly, and be held accountable for misconduct.

As part of the ASIC’s Discussion Paper, the organization will focus on preventing leaks to protect market integrity and investor confidence.

Safeguarding Market Integrity in Australia’s Equity Markets

ASIC remains vigilant in protecting the integrity of Australia’s public equity markets—among the cleanest globally. While ASIC targets insider trading and leaks ahead of market announcements, firms involved in public and private transactions must also take responsibility.

Key Expectations:

- Maintain strong internal controls—policies, training, and monitoring

- Safeguard confidential information and manage conflicts of interest

- Recognize insider information risks across both public and private markets

Ongoing Concerns:

Leaks to the media before deals like mergers or fundraising have triggered trading halts and disrupted markets. These breaches damage investor confidence and reduce Australia’s appeal as a global capital destination.

ASIC’s Position:

ASIC is actively targeting leaks and expects all market participants to manage risks effectively and hold personnel accountable.

- Focus on Data and Monitoring: ASIC emphasizes the need for improved recurrent data collection across private markets to better detect emerging risks and maintain oversight.

- Retail Investor Protection: As retail access to private investments increases (through superannuation funds and private wealth channels), regulators are considering whether existing safeguards are sufficient.

- Global Alignment: Drawing lessons from international regulatory frameworks, ASIC signals that Australia may consider tighter reporting, monitoring, and governance expectations, particularly for private equity, private credit, and other alternative asset classes.

How StarCompliance Supports These Evolving Needs

StarCompliance (Star) offers powerful, scalable solutions that align with many of the regulatory challenges ASIC has identified:

- Conflict of Interest Management: Star’s platform automates detection and disclosure of potential conflicts, critical as private markets introduce more complexity in ownership structures and governance relationships to address opacity concerns.

- Personal Trading Surveillance: As more retail and institutional investors access private markets, monitoring employee and insider trading activity across asset classes becomes vital. Star enables automated surveillance, pre-clearance workflows, and audit-ready reporting.

- Data Transparency and Audit Trails: With ASIC emphasizing better recurrent data on market activities, Star’s detailed tracking of employee activity, MNPI (Material Non-Public Information) access, and surveillance reviews helps firms maintain transparency and regulatory readiness.

- Governance Controls for New Asset Classes: Whether public equities, private equity, or digital assets, Star’s flexible compliance suite adapts to different asset types and jurisdictional requirements—supporting firms as capital flows evolve.

Conclusion

Australia’s capital markets are entering a critical phase of transformation. As regulators like ASIC sharpen their focus on transparency, monitoring, and investor protections across both public and private sectors, firms must ensure their compliance infrastructure evolves in lockstep.

Star stands ready to help firms strengthen governance, reduce risk, and build trust in an increasingly complex capital markets environment. Interested in learning more about how Star empowers firms to stay ahead of evolving global regulatory demands, schedule a personalized demo here.

Riding the Regulatory Wave