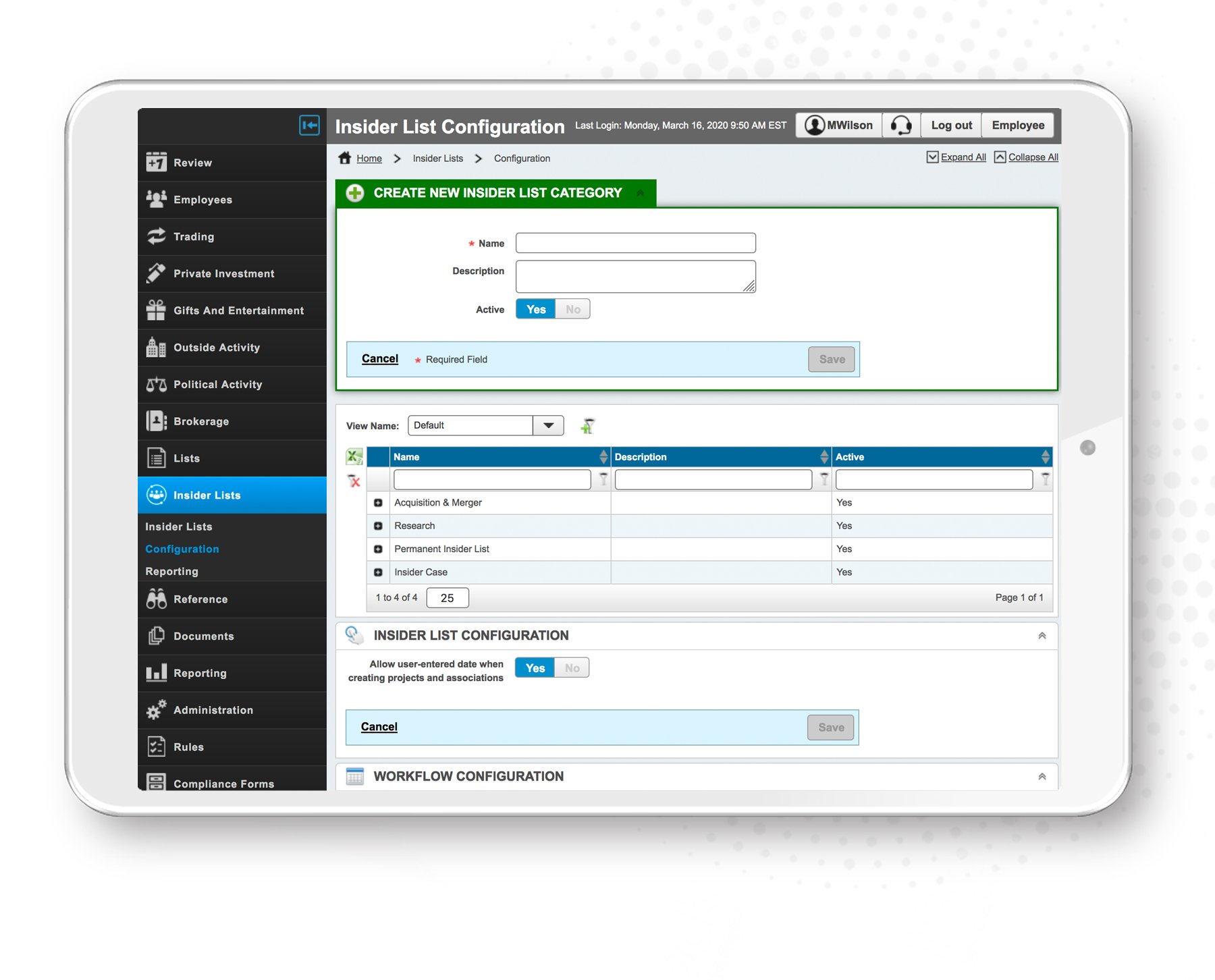

Keep your compliance team in the know and reduce the chances of market abuse with our easy-to-use insider trading solution. Track which employees have material and non-public information using insider lists and compare employee trades against high-impact global events and market activity.

02 May, 2024

On January 12, 2024, the Securities and Exchange Commission (“SEC”) charged Morgan Stanley (the “Investment Bank”) and the former head of its equity syndicate desk, Pawan Passi, with a multi-year fraud involving the disclosure of confidential information about bought deals (also known as and referred to as “block trades” and described below).

16 Apr, 2024

On Friday, April 5, 2024, a San Francisco jury found Matthew Panuwat guilty of insider trading.1 Why is this case important? Because it is the U.S. Securities and Exchange Commission’s (“SEC”) first successful so-called “Shadow Trading” conviction and now joins the Classical, Misappropriation and Tipper/Tippee Theories of insider trading.