Annual Crypto &

Annual Crypto &

Compliance Survey

2023 Summary Findings

Introduction

43% of firms surveyed now have an employee crypto-trading policy in place, up 6% vs 2022. These policies centered around the need for employees to pre-clear crypto assets as they would with other securities; prohibition of crypto mining and participation in initial coin offerings (ICOs); and disclosure of crypto trading accounts and holdings for future regulations. While this is a modest increase, it highlights growing recognition of the importance of having a crypto-trading policy in place, as regulations continue to develop.

Some of those who did not have a crypto-trading policy in place cited that crypto assets are already captured in the same trading policies as securities and grant exemptions. Alternatively, they were already established in their current conflicts of interest policies that refer to trading in shares and crypto, and therefore a separate policy was not required.

These sentiments echoed what we saw in our 2021 and 2022 surveys, in which firms stated they had updated the language of their compliance processes to report digital assets, and/or now required employees to pre-clear all trades.

If your firm already has an employee crypto-trading policy in place, when was it implemented?

- In the last 12 months: 11.5%

- 1-2 years ago: 34.5%

- 3-4 years ago: 50%

- More than 4 years ago: 4%

A large majority of respondents (88.5%) had already implemented employee crypto-trading policy over a year ago, as trading of digital assets becomes increasingly established and is gradually being considered a ‘business as usual’ activity. However, some have only just started their compliance protocols for the relatively new asset class, so have some catching up to do.

If you don’t have an employee crypto-trading policy in place, are you planning to implement one in 2024?

Just over a quarter (23%) of respondents who have not yet implemented an employee crypto-trading policy intend to do so in 2024. This was down 5% from the findings in our 2022 Crypto and Compliance Market Study.

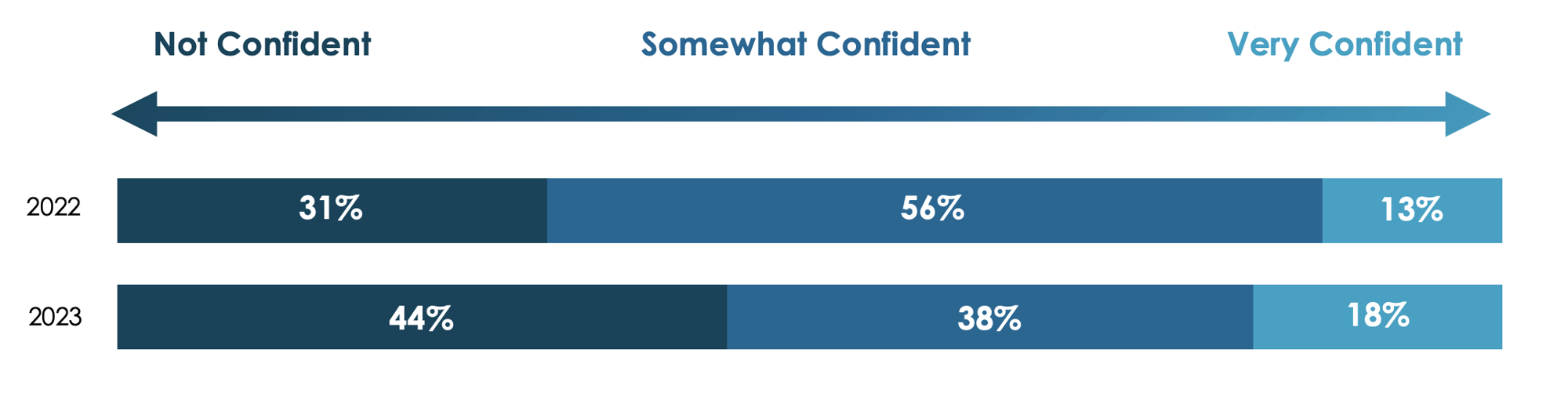

Are you confident that you know how your firm’s employees are trading crypto

instruments in their personal accounts?

The number of people “not at all confident” in their understanding of how employees are trading crypto instruments in their personal accounts increased 13% year-on-year. This was surprising considering that more firms had implemented an employee crypto-trading policy, or had updated the language of their existing compliance policies for employees to report crypto and digital assets. This might be because firms are still getting to grips with the challenges of monitoring activity in this burgeoning area.

On the flip-side, those who are “very confident” increased by 5% year-on-year. This suggests that, while having a policy in place has been educational for some firms and improved their awareness of employees’ crypto-trading behavior, many still need to look at where their current policies fall short, and how they can gain further transparency into this activity.

What is the approximate age breakdown of your firm’s employees who trade crypto assets?

Similar to the results of our 2022 Crypto and Compliance Market Study, in 2023 firms identified Millennials (32%) as the generation of employees that trade crypto assets the most. Interestingly, in 2023, more firms (61%) had less of a grasp on which age groups were trading crypto assets and rose sharply, up from 27% in 2022.

This may reflect the lower levels of confidence in the understanding of how employees are trading crypto instruments in their personal accounts as seen in Figure 4. It may also be due to firms not needing to record the demographic breakdown or because anti-age discrimination policies discourage this.

What percentage of employees' tradable assets do you believe are invested in crypto?

Just under half (45%) of respondents estimate that their employees invest less than 25% of their tradable assets in crypto – a fall of 12% year-on-year. However, it was interesting to see that a small minority (2%) invested more than half of their tradable assets in crypto. A potential reason for this could be the increasing price of leading cryptocurrencies and digital assets – such as Bitcoin, which rose by 155%, and Ethereum, which rose by 91%, in 2023 – with some employees looking to make headway on those trends.

Nonetheless, the results highlight that the number of firms not knowing how much of their employees’ tradable assets are invested in crypto increased by 13% year-on-year.

When do you think crypto regulations, such as the MAS stablecoin regulatory framework, the SEC's aggressive pursuit of the crypto industry in general in the US and MiCA in the EU, will start having an impact on your team or the business as a whole?

39% of respondents expect that regulations and guidance for employee crypto-trading activity will come into force in the next 18 months, down 21% vs our 2022 Crypto & Compliance Market Study. This may reflect the growing realization that regulators are taking more time than anticipated to draw up regulations and publish much-needed guidance.

How will your firm be monitoring and managing employee crypto-trading risks, as their use becomes increasingly widespread?

- By investing in crypto monitoring software: 14%

- Through our current compliance software: 49%

- Through Excel or other manual processes: 3%

- I won’t be monitoring it: 16%

- Other (please specify): 18%

The majority of respondents (63%) are looking to monitor and manage employee crypto-trading risks by investing in or using compliance/monitoring software, with just under half (49%) planning to use their current compliance software (which might not necessarily be fit-for-purpose). However, a significant number of those who choose “Other” mentioned that they would wait for further guidance from regulators before deciding on how they should approach and monitor employee crypto-trading activities.