You can also pre-clear with the following STAR products:

Personal Trading, Gifts & Entertainment, Outside Activity, Private Investments

Centralize and simplify your data and your searches

Save time and reduce risk through process automation

REACT FASTER

Daily alerts mean any new contributions reported to the public database get in front of you pronto, with no time spent searching site after site for contributions that put the firm at risk.

INTEGRATE FULLY

A powerful API lets users integrate political contributions data into existing firm systems, and a built-in workflow ensures the data is easily and completely accessible for casework or audits.

GO LIVE FASTER

New users are never kept waiting for long. Once your firm is onboarded, you'll be up and running within days and the risk associated with employee political activity starts going down.

WORK SMARTER

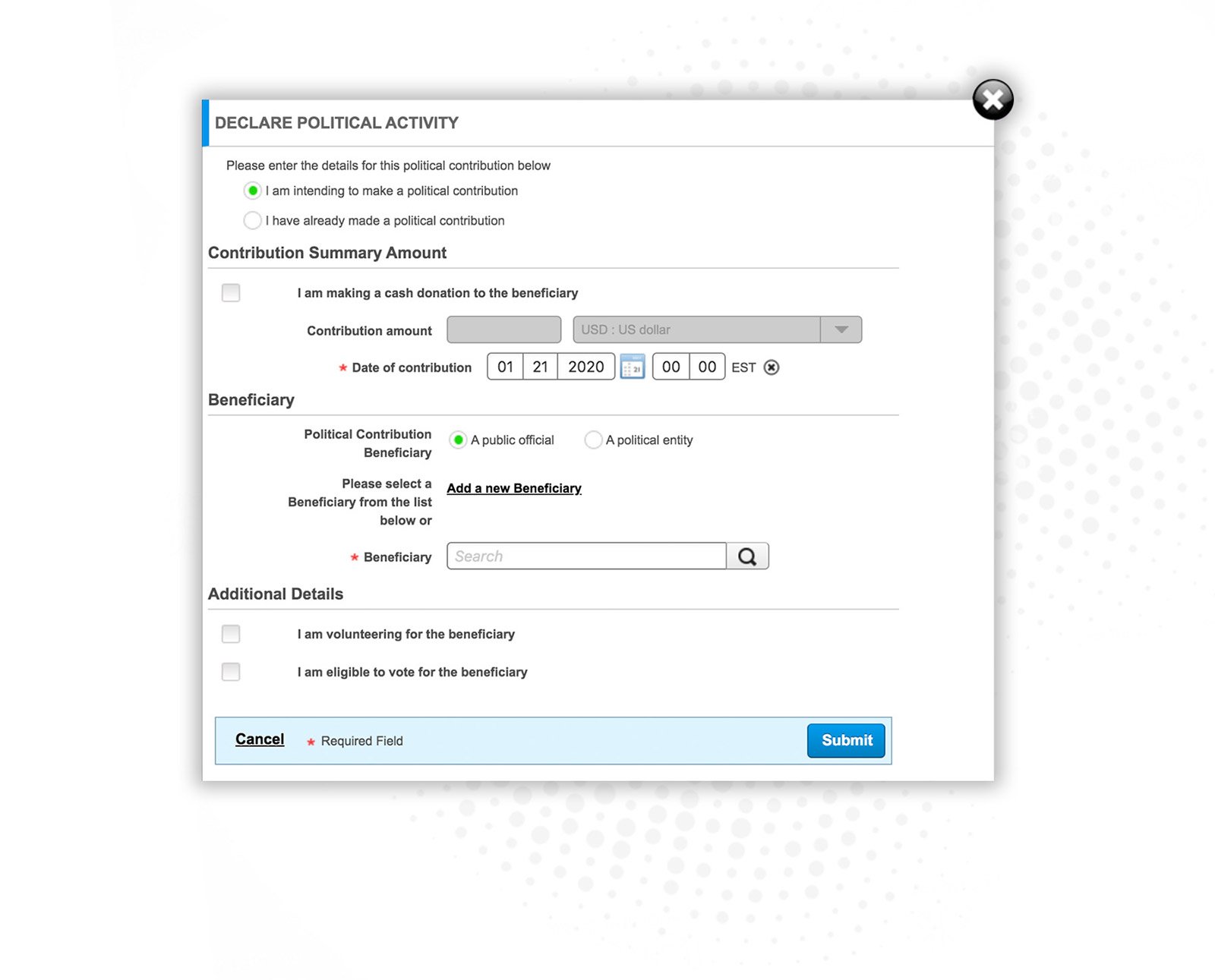

Navigate easily with intuitive UI, filters, and searches. Innovative features, like memo fields that can be saved against records to evidence review means your bases are always covered.

SEARCH MORE WIDELY

With a database of over 14,000 nicknames, we capture name variations of your monitored employees and their family members to lessen the chance of risky activity going unnoticed.

CAPTURE MORE BROADLY

People can have more than one address. We capture them all, so you can be sure contributions aren’t going unmonitored just because the same person contributed in different states.

FRESH DATA DAILY

Data is collected daily but how often it’s refreshed by the federal government, states, or municipalities can vary. Typically, the more populous the state the more frequently the data is published publicly.

EXPORT WITH EASE

Data can be exported in an editable Excel/CSV format by employee groups or at the individual level so you can sort, manipulate, and review it on your own terms.

DATA PRIVACY

Due to state privacy laws, users only have access to the contributions made by firm employees and their family members, not to the entire contribution database.

16 Apr, 2024

On Friday, April 5, 2024, a San Francisco jury found Matthew Panuwat guilty of insider trading.1 Why is this case important? Because it is the U.S. Securities and Exchange Commission’s (“SEC”) first successful so-called “Shadow Trading” conviction and now joins the Classical, Misappropriation and Tipper/Tippee Theories of insider trading.

09 Apr, 2024

With another IAF deadline fast approaching, firms are looking for ways to prepare themselves for the next cycle in compliance success, if they haven’t already. In Star's recent webinar with Áine Hickey, Vice President at the Compliance Institute of Ireland, and Kian Caulwell, Partner & Head of Financial Services Consulting at Mazars Ireland, we explore the current mindset among firms and the striking realities of increased accountability in financial services.

05 Apr, 2024

With the Financial Accountability Regime (FAR) in Australia going live on 15 March 2024 for the banking industry, firms need to have in place robust frameworks to ensure seamless adoption and continually demonstrate compliance with the new regulation.